Submitting a bank statement is a critical step in most visa application processes. This document demonstrates proof of financial stability, showing applicants can support themselves during their stay abroad. However, some individuals attempt to secure visas by submitting fraudulent bank statements.

Embassies and consulates, equipped with cutting-edge technology and strict verification protocols, are experts at identifying fake documents. In this article, we’ll uncover how embassies detect fake bank statements, the advanced tools they rely on, and the serious consequences for those caught attempting fraud.

Why Bank Statements Matter in Visa Applications

Bank statements play a pivotal role in visa applications for several reasons:

- Proof of Financial Stability: Applicants must show sufficient funds to cover expenses like accommodation, travel, and living costs.

- Verification of Intent: A stable financial background reassures authorities that applicants won’t overstay or become a financial burden.

- Compliance with Visa Rules: Some visas require a minimum balance maintained over a specific period to ensure eligibility.

Given their importance, embassies have developed robust methods to scrutinize bank statements with precision.

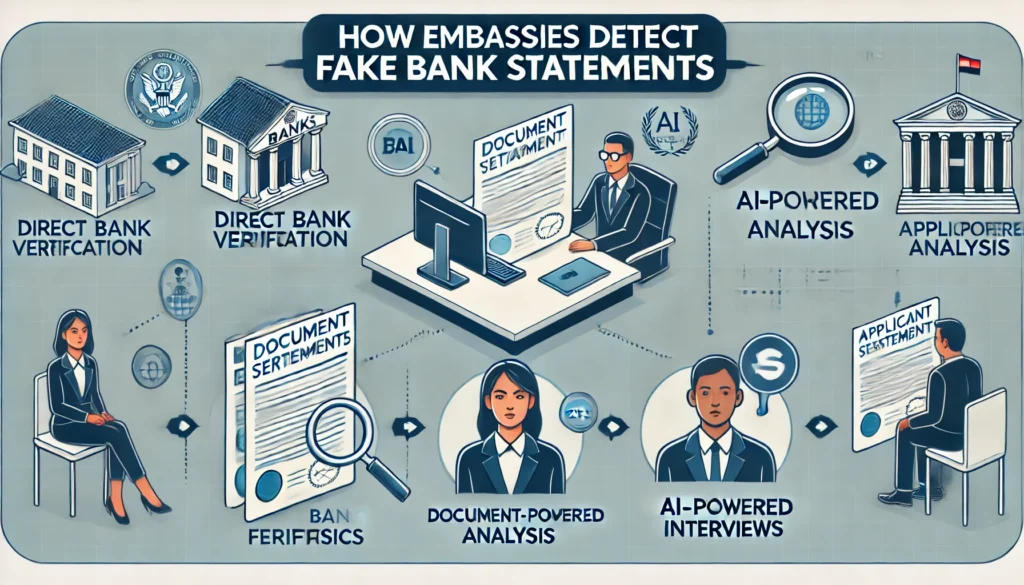

How Embassies Detect Fake Bank Statements

Embassies employ a mix of advanced technology, manual checks, and institutional partnerships to verify bank statements. Here’s an in-depth look at their methods:

1. Direct Bank Verification

Embassies often contact the issuing bank to confirm details, such as:

- Account holder’s name and account number.

- Balance consistency over the stated period.

- Transaction patterns.

Secure networks like SWIFT ensure reliable communication between embassies and financial institutions.

2. Document Forensics

Fake bank statements are frequently crafted using editing software. Embassies analyze:

- Digital Seals and QR Codes: Genuine bank statements often include verifiable digital signatures.

- Metadata: Edited files may reveal tampering through embedded data.

- Formatting Consistency: Inconsistencies in font size, alignment, or logo placement are red flags.

3. Fraud Pattern Recognition

Embassies use historical fraud data to identify anomalies like:

- Sudden large deposits before submission.

- Absence of regular income transactions.

- Bank statements from suspicious institutions.

4. Forensic Software

Embassies utilize forensic tools to detect tampering, such as:

- Layer analysis to spot document editing.

- Authentication of watermarks and other security features.

5. Third-Party Verification Agencies

Embassies often collaborate with agencies specializing in financial document verification. These agencies leverage global databases to ensure authenticity.

6. Cross-Referencing Documents

Authorities compare bank statements with other supporting documents, such as:

- Employment Letters: Verifying salary details align with income records.

- Tax Returns: Checking consistency between tax data and financial statements.

7. Applicant Interviews

During visa interviews, applicants may face financial questions, such as:

- Sources of large deposits.

- Regular income and savings patterns.

- Explanations for unusual transactions.

Inconsistent answers can prompt deeper investigations.

Technological Tools Used by Embassies

Embassies rely on advanced technologies to detect fake documents, including:

1. OCR Software

Optical Character Recognition tools extract and analyze text from documents, flagging inconsistencies.

2. AI Fraud Detection

Machine learning systems analyze thousands of applications to spot repetitive patterns or irregularities.

3. Blockchain Systems

Blockchain-secured financial records make tampering nearly impossible, allowing embassies to confirm authenticity.

4. Digital Verification Platforms

Many banks provide verification portals, enabling embassies to authenticate documents using unique codes.

Consequences of Submitting Fake Bank Statements

Submitting fraudulent bank statements can lead to severe repercussions, including:

- Visa Rejection: Applications are immediately denied if fraud is detected.

- Blacklisting: Offenders may be barred from reapplying for visas to the same country.

- Legal Action: Some embassies involve law enforcement, resulting in fines or imprisonment.

- Hindered Future Applications: A history of fraud may impact visa applications to other countries.

How to Avoid Visa Application Issues

To ensure a smooth visa process, follow these best practices:

- Submit Authentic Documents: Only use genuine statements issued by your bank.

- Maintain Consistency: Ensure your transactions match your declared income and expenses.

- Provide Supporting Evidence: Include tax returns, salary slips, and employer letters to strengthen your case.

- Consult Experts: When in doubt, seek guidance from visa professionals or immigration lawyers.

Real-Life Cases of Visa Fraud

Visa fraud has made headlines globally. For instance:

- In India, a group of applicants was caught using fake bank statements for U.S. visas, resulting in bans and legal action.

- In Nigeria, authorities uncovered a syndicate creating fake financial documents, leading to widespread arrests.

These cases highlight the risks and consequences of submitting fraudulent documents.

Conclusion

Embassies are equipped with advanced tools and strategies to detect fake bank statements. By prioritizing honesty and transparency, applicants can avoid rejection and legal issues. Understanding these detection methods and following best practices can significantly improve your chances of securing a visa.